Data Security

We take your privacy seriously. All interactions are subject to our Terms of Service, Privacy and Cookie Policies.

Follow Us

Get the latest news delivered to your inbox.

How to Lower Solar Energy Acquisition Costs in the USA

Share with Friends

The US solar rebate is a financial incentive aimed at promoting the use of solar energy by homeowners and businesses. The rebate can be worth up to 30% of the cost of a solar system, making it one of the most generous in the world. It provides a financial incentive to install solar panels on your roof, and get any electric company to buy the excess electricity that you produce. The value of the US solar rebate varies by state, ranging from as little as $0.75/watt up to $3.

The rising cost of energy and the need for sustainable energy sources has led to a resurgence in the popularity of solar energy.

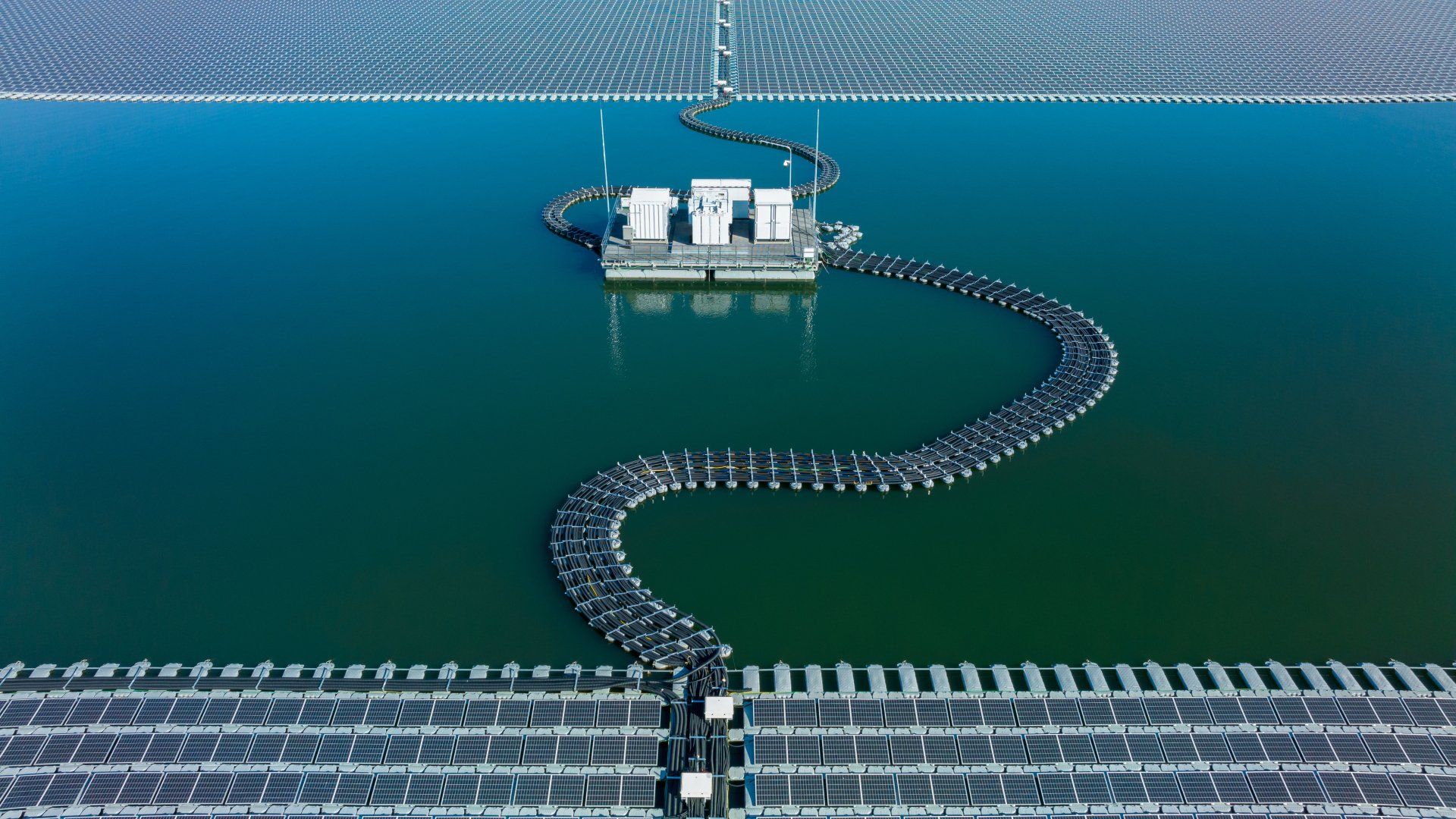

Solar panels are used for a variety of purposes due to their versatility and long lifespan. It is estimated that every year, the use of solar energy has increased exponentially with the advancement of technology.

The US solar rebate is a financial incentive aimed at promoting the use of solar energy by homeowners and businesses. The rebate can be worth up to 30% of the cost of a solar system, making it one of the most generous in the world. It provides a financial incentive to install solar panels on your roof, and get any electric company to buy the excess electricity that you produce. The value of the US solar rebate varies by state, ranging from as little as $0.75/watt up to $3.

Solar rebates are available in all 50 states, making it easy for homeowners to take advantage of them.

There are many benefits to using a solar system, including reducing your carbon footprint and saving money on your energy bills. A solar system can also increase the value of your home.

Tax Rebates

One way the US government encourages people to install solar systems is by providing a tax rebate. The tax credit is determined by multiplying the size of your system by $0.16/watt. For example, if you are installing a 2 kW system, the tax credit is $0.62 per watt. However, the $0.

Net Metering

Another financial incentive for solar system owners is net metering. Net metering is a billing system that allows the solar owner to charge the utility company for energy produced and battery storage that is charging. The utility company must credit the excess of energy produced by the solar system overconsumption, with any money owed on the battery bank. Net metering is typically a 2 to 1 ratio with the utility company. For example, if your system produces 1,000 kWh of energy and you consume 880 kWh, then you owe the utility 200 kWh.

Solar Renewable Energy Certificates (SRECs)

In some states, the owner of a solar system can sell the electricity it produces to the local utility company in the form of Solar Renewable Energy Certificates (SRECs). SRECs are created when a solar system generates more power than it uses. The state utility company is required to purchase these certificates and use them to offset its own carbon emissions.

Federal Tax Credits

The federal government offers a tax credit of up to 30% of the cost of installing a solar system.

When you file your taxes this year, don't forget to take advantage of the federal government's tax credits for energy-efficiency improvements. There are tax credits available for homeowners who install solar panels, wind turbines, insulation, and high-efficiency appliances. The credits range from 10% to 30% of the cost of the improvement, with a maximum credit of $1,500 per improvement.

The tax credits are available for both homeowners and renters. Homeowners can claim the credit on their primary residence or on a second home. Renters can claim the credit if they live in a property that is owned by someone else and that has been certified as energy-efficient.

To qualify for the tax credit, the improvement must meet certain standards set by the Department of Energy.

Solar rebates are a great way to reduce your carbon footprint and save money on your energy bills in all 50 states across the United States.